Simple depreciation formula

I 100000 7 125. Applying the formula So the manufacturing company will depreciate the machinery with the amount of 10000 annually for 5 years.

Depreciation All Concepts Explained Oyetechy

Dividend 2000 Therefore the company paid out total dividends of 2000 to the current shareholders.

. Depreciation is the expensing of a fixed asset over its useful life. You may also look at the following articles to learn more Guide To Retained Earnings Formula. A third method for expensing business assets is the depletion method which is an accrual accounting method used by businesses.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Accumulated Depreciation Formula Example 1. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

Simple Interest Formula Example 2. The effect of a tax shield can be determined using a formula. When the cost of asset residual value and useful life of an asset is given.

This is expected to have 5 useful life years. This lets us find the most appropriate writer for any type of assignment. This has been a guide to Income Statement formula.

Year 1 depreciation. Depreciation can be computed without any difficulty but it is not easy and simple. Example of straight-line depreciation without the salvage value.

Here we discuss How to Calculate Income Statement along with practical examples and downloadable excel template. Under this method Asset can be depreciated up to the net scrap value or zero value. The formula for calculating straight-line depreciation is as follows.

The company takes 50000 as the depreciation expense every year for the next 5 years. Double declining balance is calculated using this formula. Best Examples of Interest Expense Formula.

Depreciation is the gradual decrease in the book value of the fixed assets. If the inflation rate during the period is expected to be 2 then calculate the real interest rate as per the full formula and the approximate formula. Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset straight-line depreciation As you can see this formula is fairly simple to perform and offers a straightforward estimate as to the depreciation value of an asset.

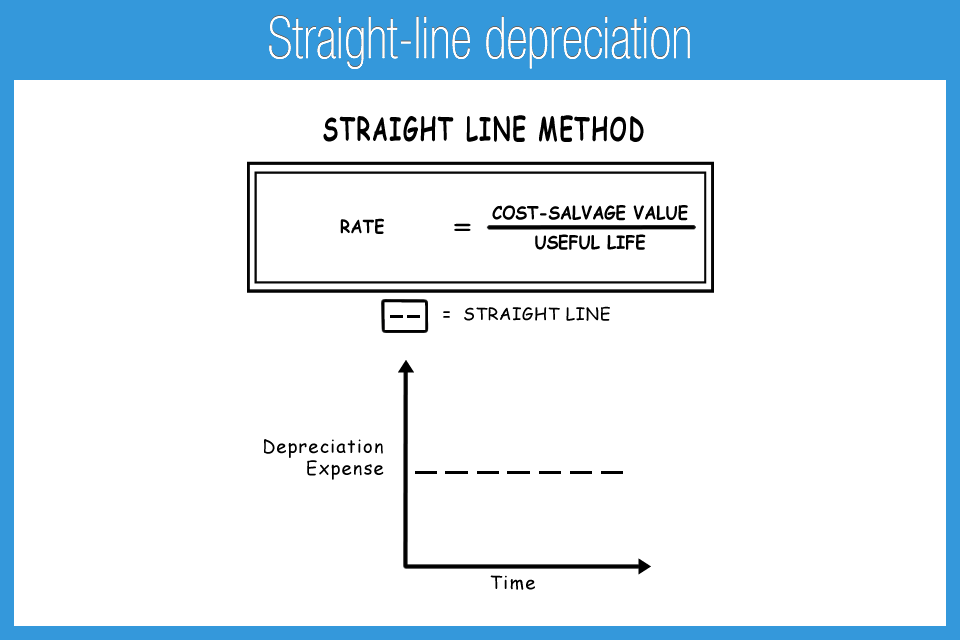

Accumulated depreciation formula after 3 rd year Acc depreciation at the start of year 3 Depreciation during year 3 40000 20000 60000 Example 2. Cost of the asset recovery period. Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion.

Annual Depreciation Expense Cost of an asset Salvage ValueUseful life of an asset. Let us take the example of David who has recently invested a sum of 20000 in a long term deposit fund. To get that first calculate.

The salvage value is Rs. Annual depreciation expense 60000 - 10000 50000. Let us take another example where the company with net earnings of 60000 during the year 20XX has decided to retain 48000 in the business while paying out the remaining to the shareholders in the form of dividends.

I Rs8750 So the interest earned by an investor on the redeemable bond is Rs8750. Read about the depreciation formula and Expense. Next determine the assets residual value which is the expected value of.

The higher the net profit margin the more money a company keeps. Stay tuned to BYJUS. The net profit margin allows analysts to gauge how effectively a company operates.

Now lets look at how much that same MacBook would depreciate under the double declining balance and the sum of years methods. Company ABC bought machinery worth 1000000 which is a fixed asset for the business. Straight line depreciation percent 15 02 or 20 per year.

The formula for annual depreciation under straight line method is as follows. The tenure of the fund is 10 years and the annualized nominal interest rate offered is 4. It is a very simple method of calculating depreciation.

Computation of depreciation under straight line method is comparatively easy and simple. 2 x basic depreciation rate x book value. The net profit margin is a ratio formula that compares a businesss profits to its total expenses.

Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. This is usually the deduction multiplied by the tax rate.

Explanation of Straight Line Depreciation Formula. Straight Line Depreciation Formula. Since depreciation is a non-cash expense and tax is a cash expense there is a real-time value of money saving.

More study material from this. Let us calculate the accumulated depreciation on the balance sheet at the end of the financial year ended December 31 2018 based on the following information. Following formula should be applied under given conditions.

The straight Line Depreciation formula assumes that the benefit from the. The formula for depreciation under the straight-line method can be derived by using the following steps. ABC Ltd has taken a Long-term borrowing of INR 1000000 with an interest rate of 55 per annum from DCB Bank.

Company X considers depreciation expenses for the nearest whole month. Calculate the simple interest paid by ABC Ltd. Now you will notice some differences between the values of formula1 and 2.

Interest Rate Formula is helpful in knowing the Interest obligation of the borrower for the loan undertaken and it also helps the lender like financial institutions and banks to calculate the net interest income earned for the assistance given. Sometimes we want to calculate the distance from a point to a line or to a circleIn these cases we first need to define what point on this line or circumference we. The double declining balance formula.

Dividend Formula Example 2. I P R T. To increase cash flows and to further increase the value of a business tax shields are used.

Firstly determine the value of the fixed asset which is its purchase price. The distance formula we have just seen is the standard Euclidean distance formula but if you think about it it can seem a bit limitedWe often dont want to find just the distance between two points. After 6 years and also find out the total amount Simple Interest paid by the Company at the end of tenure.

Useful life 5. The reason is that there is an exceptional item called Loss on extinguishment of debt which is around 30 million that comes between Operating Income Operating Income Operating Income also known as EBIT or Recurring Profit is an important. Based on a QuickBooks Simple Start Plan at its regular retail price of 22 per month and a 31 day month.

Cost per day claim. By making all adjustments to net income we arrive at the actual net amount of cash received or consumed by the business. So EBITDA -116 325 -126 570 653 million.

It has a useful life of 10 years and a salvage value of 100000 at the end of its useful life. Gross Cost as on January 1 2018. Calculator For Times Interest Earned Formula.

The simple formula above can be built on to include many different items that are added back to net income such as depreciation and amortization as well as an increase in accounts receivable inventory and accounts payable. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method.

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Depreciation Accountingcoach

Depreciation Expense Double Entry Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Account Salvage Value

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Double Entry Bookkeeping

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Macrs Depreciation Calculator With Formula Nerd Counter

Accounting With Damien Labrooy 𝐖𝐡𝐚𝐭 𝐢𝐬 𝐒𝐭𝐫𝐚𝐢𝐠𝐡𝐭 𝐋𝐢𝐧𝐞 𝐃𝐞𝐩𝐫𝐞𝐜𝐢𝐚𝐭𝐢𝐨𝐧 With The Straight Line Depreciation Method The Value Of An Asset Is Reduced Uniformly Over Each Period Until It Reaches Its

What Is Straight Line Depreciation Method Pmp Exam Youtube

Method To Get Straight Line Depreciation Formula Bench Accounting

Exercise 6 5 Compound Depreciation Year 10 Mathematics

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template